Beyond the AI: How CCM Trends are Shaping the BFSI Customer Experience in 2026

January 8, 2026

In 2025, customer experience initiatives shifted from a cost-cutting mindset to a customer-centric approach. This and other CCM trends are widely observed in industries like e-commerce, which tend to shape the CX perspectives for complex B2C, B2B, and G2B industries. For banks and insurers the picture doesn’t change: instead of just cheap, compliant mailings, firms now prioritise great digital experiences – using AI, cloud, and personalisation to delight customers.

This article explores 5 key CCM trends of 2025 reshaping BFSI communications and setting the stage for 2026.

Cost vs. Experience – 0 : 1

Until recently, companies chose CCM platforms mostly to cut costs and meet compliance. Now that’s flipped – in 2025 the top objective for customer communications is improving the customer experience. Market data confirms this pivot, as organisations move from “cost containment” to customer-centric innovation powered by AI and automation. Banks and insurers are retiring legacy CCM in favor of cloud-native solutions.

For example, one of our clients – the mid-sized insurer from the Netherlands – managed to deploy CCM on their own private cloud on Microsoft Azure with integration partners for greater agility and control, instead of using a vendor’s one-size-fits-all cloud. The payoff is clear: more engaging communications, quicker content updates, and lower churn – turning CCM from a cost center into a strategic CX engine.

AI-Powered Hyper-Personalisation – Top in CCM Trends

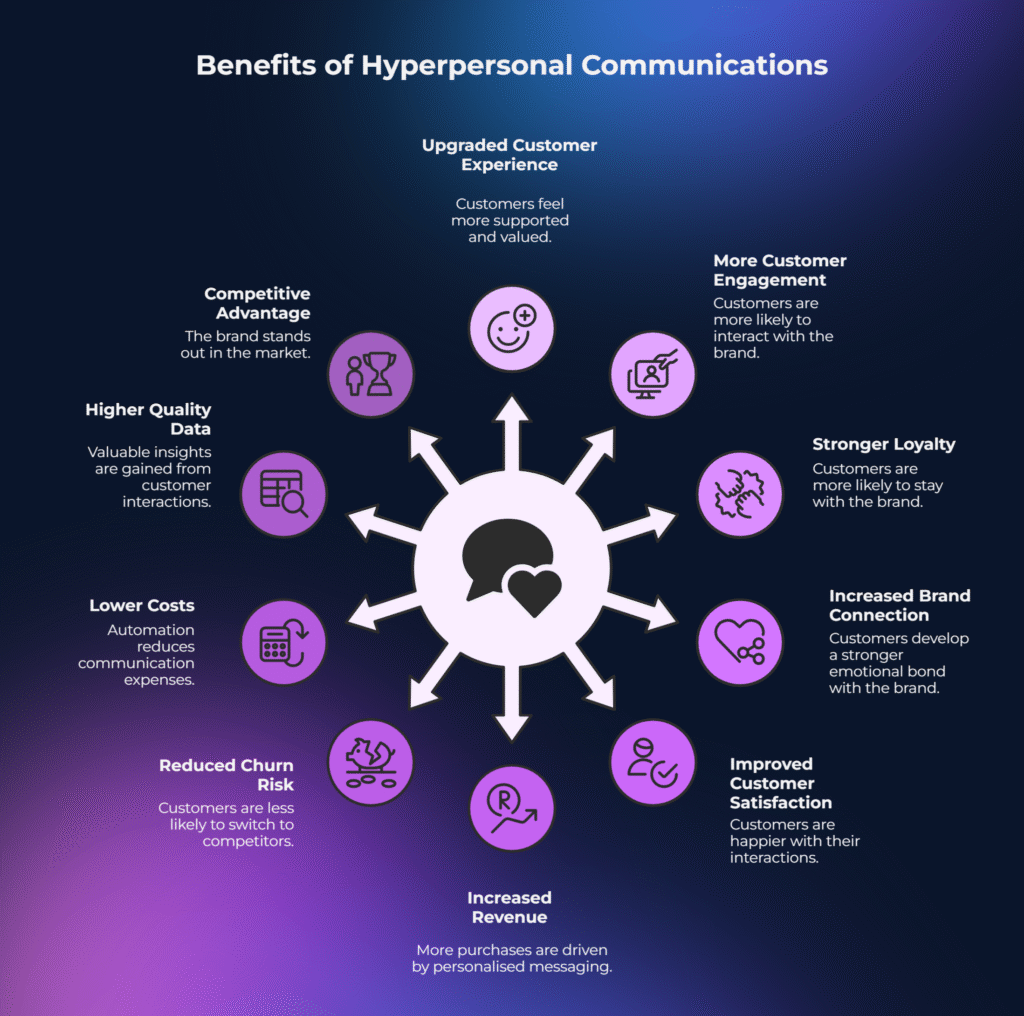

Personalisation in communications went into overdrive in 2025. Instead of generic mass emails, banks and insurers now leverage AI-driven CCM to craft one-to-one messages for each customer. Hyper-personalisation uses real-time data and predictive analytics so that content (alerts, push-notifications etc.) matches an individual’s needs at that moment.

For example, generative AI can ensure data is accurate and even suggest a product a customer might need before they realise it. This practice is no longer experimental – it gained significant momentum in 2025 and continues to expand as AI capabilities mature. AI tools like chatbots and automated language translation also help deliver a more personal, convenient experience.

The result is communications that feel custom-made for every client, which significantly boosts engagement and satisfaction.

Coming to 2026 with PDF Accessibility and EAA Compliance

A regulatory shift in 2025 made accessible communications a must-have. The European Accessibility Act (EAA) now requires that all customer documents (bills, statements, policies, etc.) be readable by assistive technologies. Legacy CCM systems struggle here – they place text for print but don’t include the tags and structure that an accessible PDF needs. The risk of non-compliance is serious: regulators have already fined companies (the Spannish airline Vueling was hit with €90,000) for inaccessible content.

As a result, banks and insurers are overhauling how they generate documents. Modern CCM platforms bake in accessibility by design, automatically tagging PDFs to meet standards.

Banks vs. Fintech – What Shapes What

An important 2025 development is the innovation gap in communications. Many big banks remain bogged down by legacy tech, while fintech challengers leap ahead with AI and cloud. This technical gap becomes more significant, leaving traditional banks behind in a significantly evolving era of digital transformation. Banking and insurance giants, which have been deserving of the trust and customer preferences for centuries, are at risk of losing it in 2026.

One of the surveys says that 66% of bank IT leaders said that trying to run AI on outdated core systems is “like fueling an EV with petrol”, and nearly 80% agreed fintechs are racing ahead as a result. But some incumbents are actively rewriting that story.

Santander Portugal, for example (3M+ customers, 150M+ communications per year), moved away from an outsourced, PSP-dependent setup where sensitive data left the bank’s environment and template changes were slow and vendor-bound. By migrating to Quadient Inspire Evolve, the bank brought communications back under tighter governance – enabling faster template updates, shorter time-to-market for regulatory changes, and end-to-end control with traceability in a cloud-native model.

Market Shake-Up: Who Leads the CCM Trends?

The CCM software market is evolving fast, and Quadient now holds the #1 global CCM market share at 11%.

Legacy-only vendors are fading, while those enabling agile, personalised communications are rising.

IDC observes that organisations are investing in AI-driven communication platforms that personalise engagement across all channels, which helps make the experience less and less fragmented. In other words – omnichannel and cohesive.

For example, a customer starts a policy renewal on email, pauses it halfway, then later calls the insurer — the agent immediately sees exactly what message was sent, what document version was opened, and where the customer dropped off, without asking them to repeat anything. If the customer ignores the email but clicks the SMS link instead, the system automatically continues the same conversation there, rather than restarting it. When regulations or personal data change at the last minute, the platform updates the content once and reflects it consistently across email, portal, PDF, and call-center screens, avoiding contradictory messages.

For regulated industries, it’s crucial to have responsible AI implementation. Every message, pop-up or email should reflect the clear connection between the business and end customer. Quadient’s platform AI adapts communication to customer needs – speeding content creation, personalising messages, and automating workflows for users. And in 2025, many enterprises followed this lead: phasing out old document systems and choosing CCM solutions built for flexibility and intelligent automation.

Going in to 2026

The evolving trends won’t change the direction in 2026. In the nearest future we’ll see autonomous AI agents starting to orchestrate customer interactions in real time, taking personalisation to new heights. At the same time, the EU’s AI Act will fully kick in (by mid-2026), imposing stricter rules on AI use in customer communications.

Together, these developments mean real-time, AI-driven CCM – with robust governance – will likely become the norm. Companies that invested in modern, adaptable CCM systems are set to thrive, while others will scramble to catch up.

Brief FAQ for Produst Owners, Operational Leaders and Digital Transformation Experts

Q1: How do we justify CCM modernisation beyond “nice CX”: what metrics move in BFSI?

A: The business case comes from retention protection (fewer complaints/churn triggers), cost-to-serve reduction (call deflection from clearer statements/policy communications), and journey uplift (higher completion rates in digital servicing). Track it per use case: fraud alerts (time-to-action), renewals (drop-off), statements (inbound volume), regulatory notices (complaints/appeals). CCM becomes a revenue + risk lever once comms are treated as part of the customer journey.

Q2: Private cloud or vendor SaaS: what decides the right CCM model in 2026?

A: It’s driven by constraints: data residency, security architecture, integration complexity, and release speed. Private cloud (AWS/Azure) fits teams wanting direct infra control, enterprise-grade IAM/logging alignment, and flexible release cycles – often attractive to mid-sized firms paying for cloud + partner support rather than a full bundled stack. Vendor SaaS can win on speed-to-value but typically trades off architectural freedom.

Check our Case Study which shows the full implementation perspective and unbeatable benefits of PaaS Quadient/Azure based custom solution.

Q3: EAA-driven PDF accessibility: what does “done” mean operationally?

A: “Done” means accessibility is repeatable and auditable, not a one-off fix. You need governed templates + tagging rules, controlled reading order (tables/forms), and automated QA gates to prevent regressions. The risk isn’t only fines – it’s broken self-service (can’t read → calls, complaints, churn).

We’ve put an effort to make PDF accessibility clear to understand and easy to implement it with compliant & predictable results. Learn more about our method and template-made approach, and rid off the complication of the PDF accessibility and EAA compliance.

Conclusion

2025 didn’t just add “AI” to CCM – it changed the job description of customer communications in BFSI. When statements, policy packs, fraud alerts, and regulatory notices become part of the customer journey, CCM stops being a back-office print engine and turns into an operating system for trust: clarity, timeliness, relevance, and proof that you’re in control.

If you want to keep digging, follow the thread in three directions: what a clean legacy-to-modern migration actually looks like in CCM data migration: 6 steps to ease legacy system replacement; why accessibility is now inseparable from CX in PDF accessibility and EAA compliance; and how modern platforms are being deployed in real life in this Quadient Inspire deployment case study for a Dutch insurance company.

Let’s drive your Digital Transformation Together.

Schedule a free consultation with our team to explore how we can help you achieve your goals.