Calculating the Accessibility Non-Compliance Costs: Real Cases & Financial Impact

November 14, 2025

“Accessibility penalties are not theoretical” – that what we hear from every newspoint from the Europen Accessibility Act inforcement. Though in truth, they never were. In the USA and some EU countries, accessibility violations have long been treated as discrimination issues with legal consequences. Yet many businesses dismissed them as rare enforcement actions that “wouldn’t happen to us.”

The European Accessibility Act has changed that calculation entirely.

We analysed not only the headline-grabbing EAA announcements but dug deeper, and discovered something striking: accessibility topic has evolved from quiet supervision to loud enforcement. The cases below aren’t distant warnings or isolated incidents. They’re recent, high-profile examples where inaccessible digital services triggered significant financial penalties, operational restrictions, and reputational damage. More importantly, they serve as early indicators of how enforcement under the EAA and related regulations will evolve across Europe.

As we approach 2026, digital-based industries like e-commerce and already heavily regulated services like online banking face unprecedented scrutiny. Learn those real-world cases that illustrate how inaccessible digital services lead to measurable consequences and serve as early indicators of how EAA enforcement will evolve across Europe.

Vueling – A Well-Known Spannish Lowcost Airlines (Spain, 2024)

Spain’s National High Court fined Vueling €90,000 and temporarily barred the airline from receiving public funds after its website was ruled inaccessible under national law. Vueling’s website failed to meet accessibility standards required under Spanish Royal Decree 1112/2018, which mandates WCAG 2.1 Level AA compliance for all public-facing digital services. The court found that customers with disabilities could not independently book flights, check in, or manage reservations — the core functions of an airline’s digital platform.

The Consequence: Beyond the direct fine, Vueling’s exclusion from public funding eligibility represented a significant operational restriction. For airlines dependent on government contracts, subsidies, or participation in public transport programmes, this penalty creates cascading financial impact far exceeding the initial €90,000.

What Does This Mean?

This was one of the first major private-sector enforcement cases directly linked to EAA implementation, setting a precedent that non-compliance results in both financial penalties and operational sanctions. Spanish regulators demonstrated willingness to use multiple enforcement mechanisms simultaneously — a strategy other EU member states are now replicating.

AccessiBe – Web Accessibility Company Powered With AI (USA, 2024)

The U.S. Federal Trade Commission fined AccessiBe $1 million for making deceptive claims about its AI-powered widget’s ability to make websites WCAG compliant. AccessiBe marketed its automated overlay tool as capable of achieving full WCAG compliance through AI-driven code injection. The FTC found these claims misleading — the widget could not deliver genuine accessibility and, in many cases, actually created new barriers for assistive technology users.

The Consequence: Beyond the $1 million penalty, AccessiBe must cease making unsubstantiated accessibility claims and notify customers that their widget does not guarantee compliance. The settlement sends a clear regulatory signal: automated shortcuts will not satisfy legal obligations.

What Does This Mean for EU Businesses?

Many European companies currently rely on similar overlay solutions, assuming they provide adequate EAA protection. This case signals rising regulatory scepticism towards automated fixes across jurisdictions. Genuine accessibility work includes manual audits, proper code remediation, template-level fixes. Theywill be required to meet compliance obligations. Overlays may supplement accessibility efforts but cannot replace them.

SAS: The “Impossible to Use” Website (Norway, 2017–2018)

Again we have case with customer-first communication channel, which does not meet the minimal accessibility. Norwegian regulator Difi threatened Scandinavian Airlines with daily fines of approximately €15,000 after its redesigned booking website failed 20 of 28 tested WCAG success criteria.

In 2017, SAS launched a redesigned website that immediately drew complaints from disability organisations. Norway’s Agency for Public Management and eGovernment (Difi) conducted an audit under the country’s Equality and Anti-Discrimination Act, which mandates WCAG 2.0 AA compliance.

The results were damning. Specific failures included:

- No keyboard navigation support – interactive elements couldn’t be reached without a mouse (violating WCAG 2.1.1, 2.1.2)

- Insufficient colour contrast for text (failing WCAG 1.4.3)

- Missing alt text for images, icons, and even the SAS logo

- Inaccessible CAPTCHA with no non-visual alternative

- Unlabelled form fields and error messages relying solely on colour cues

Difi’s official verdict described the site as “impossible to use” for disabled customers — a quote that became infamous in Norwegian media.

The Enforcement Timeline

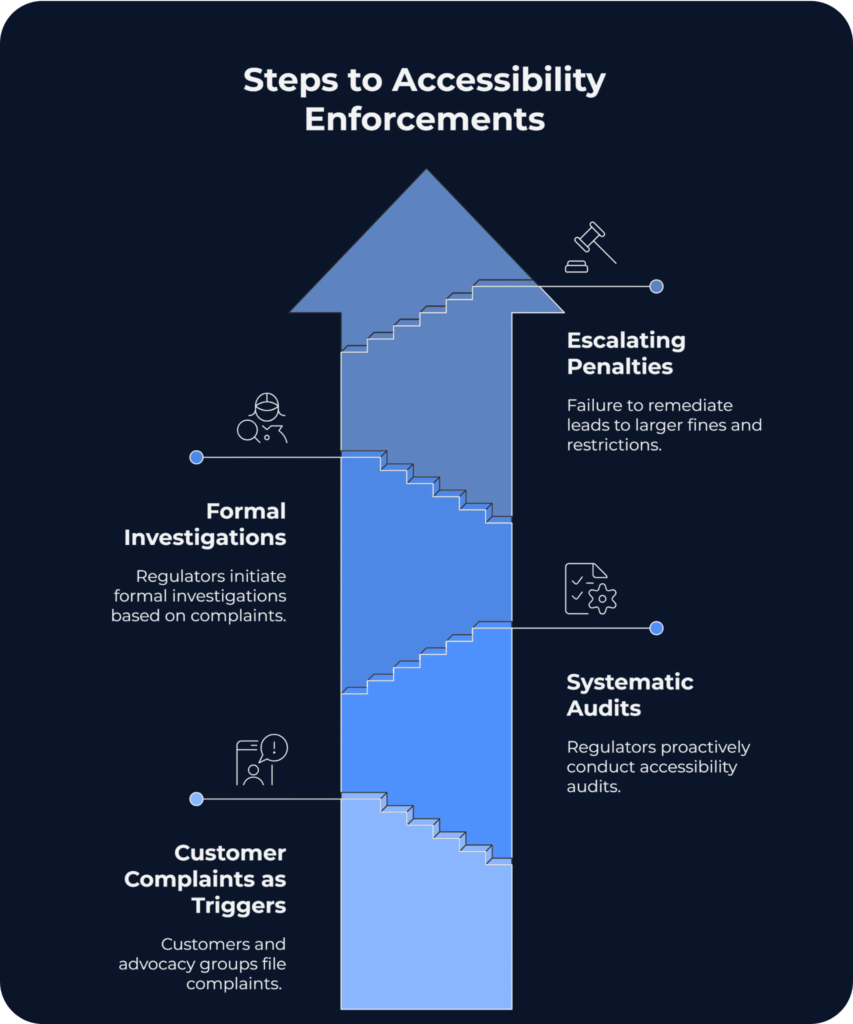

- November 2017: Difi releases audit findings, gives SAS one year to remediate.

- Mid-2018: Follow-up audit shows significant problems remain unresolved.

- August 2018: Difi issues 10-day ultimatum with threat of NOK 150,000 (~€15,000) daily fines.

- Final deadline: SAS resolves critical issues just in time to avoid penalties.

The Consequence: Whilst SAS ultimately avoided the daily fines by achieving compliance before the final deadline, the case generated extensive negative publicity. Headlines like “SAS website gets failing grade” and “SAS risks fines for new website” ran in major Norwegian newspapers. The threat of €15,000 daily accumulating fines forced immediate action and resource allocation.

What Does This Mean?

The SAS case demonstrates how daily penalty mechanisms work: an initial audit identifies violations, a compliance period allows remediation, then escalation to accumulating fines when progress stalls. Norway’s enforcement model shows that even large private companies face accountability for WCAG failures, and that daily fines create powerful incentives for rapid compliance.

By the way, SAS’s competitor, Norwegian Air, had invested in accessibility proactively and passed its Difi inspection with only minor comments — a fact widely noted during the controversy, demonstrating competitive advantage for early adopters.

Union Bank of Switzerland

UBS faced a 20,000 CHF fine plus mandatory remediation after its online banking platform was found to exclude visually impaired customers from basic operations like account login and transactions.

UBS’s digital banking interface was not screen reader-friendly or keyboard-navigable, effectively denying blind users independent access to their accounts. This violated Switzerland’s accessibility standards (based on WCAG 2.0/2.1 Level AA) and constituted discrimination under Swiss disability law.

Specific issues included:

- Missing screen reader labels and alt text (violating WCAG 1.1.1)

- Inadequate keyboard navigation (violating WCAG 2.1.1, 2.4.7)

- Critical interactive elements rendered inaccessible to assistive technology users

Swiss authorities ordered:

- Immediate payment of 20,000 CHF fine

- Mandatory accessibility improvements within 6 months

- Compensation for affected customers who had been unable to use online services

- Accessibility training for staff to prevent recurrence

What Does This Mean?

The UBS case demonstrates that financial services face particularly strict scrutiny. Banking accessibility isn’t just about compliance. But it’s about fundamental access to financial services, which courts and regulators treat as essential infrastructure.

Notably, Swiss law allows individual discrimination claims with awards up to CHF 5,000 per person. For banks with thousands of affected customers, the potential liability extends far beyond the initial fine. The requirement to compensate affected users sets a precedent that inaccessibility creates measurable financial harm requiring restitution.

Common Patterns Across Enforcement Cases

These cases reveal consistent enforcement approaches emerging across jurisdictions:

1. Multiple Penalty Mechanisms: Financial fines (fixed or daily accumulating), operational restrictions (funding eligibility), mandatory remediation timelines, customer compensation requirements, and staff training obligations.

2. Focus on Core Functionality: Regulators prioritise accessibility failures that prevent users from completing essential tasks—booking flights, accessing bank accounts, completing purchases. Cosmetic or minor issues receive less scrutiny than barriers to critical services.

3. No Safe Harbours for Large Companies: Major airlines and multinational banks face the same enforcement as smaller entities. Brand recognition and market position provide no protection from accessibility requirements.

4. Automated Solutions Face Scepticism: The AccessiBe ruling signals that overlay widgets and AI-driven “quick fixes” will not satisfy regulators. Genuine code-level accessibility and manual validation are increasingly required.

5. Daily Fines Create Urgency: The SAS case demonstrates how daily accumulating penalties (€15,000/day = €450,000/month) force immediate resource allocation and executive attention in ways fixed fines may not.

Calculate Your Exposure

Ask yourself:

- How many customer-facing channels your organisation operate?

- What percentage meet PDF/UA and WCAG 2.1 AA standards?

- If each inaccessible online communication a potential violation, what’s your total exposure?

For example, for a bank generating 50,000 monthly PDF statements:

- If 0% are accessible and individual fines reach €1,000 per violation (conservative estimate)

- Potential exposure: €50 million monthly

Even if only 1% of customers file complaints, that’s €500,000 in immediate risk—before considering reputational damage, operational restrictions, or daily accumulating penalties for non-remediation.

The organisations thriving post-EAA aren’t debating whether accessibility matters. They fixed their digital communication channels before enforcement arrived.

Let’s drive your Digital Transformation Together.

Schedule a free consultation with our team to explore how we can help you achieve your goals.