EAA-ready Document Communications for Banking: Implementing Accessible Templates for a Leading Polish Bank

November 27, 2025

While nearly 45% of EU companies have yet to begin their accessibility efforts, this Polish bank chose a different path. Instead of waiting for regulatory pressure, they launched a forward-looking programme to bring all customer-facing documents in line with the highest accessibility standards ahead of the European Accessibility Act deadline. In practice, they set out to build EAA-ready document communications, treating accessibility not as a last-minute obligation, but as a core element of service quality, trust, and customer experience.

The Business Context: Why This Bank Acted Early

A 2025 Irish study shows that 61% of organisations identify technical implementation as the biggest barrier to EAA compliance. This bank recognised that challenge long before most of the market and chose to act early, turning what many firms see as a burden into a competitive advantage. The bank recognised that challenge early and addressed it proactively through partnership rather than struggling internally with education, manual implementation, document remediation and supporting the cross team collaboration.

Serving 1.5 million consumer finance customers, the bank viewed accessibility not simply as regulatory hygiene but as part of a broader strategy rooted in sustainability, inclusivity, and service excellence. By moving ahead of the EAA curve, they strengthened customer trust, reduced future remediation costs, and ensured operational continuity when enforcement tightens.

Same time, the bank’s upcoming collaboration with Quadient Inspire Technology positioned them well for this transition. However, implementing accessibility at scale across diverse document types required specialist expertise they didn’t possess internally. That’s where Quertum’s partnership became essential.

Facts Summary

Client: One of Poland’s largest financial institutions specialising in consumer credit and automotive financing. The Polish branch operates within an international banking group serving approximately 7.5 million customers nationwide, including around 1.5 million in the consumer financing division. In practical terms, 1 in 5 Polish citizens uses this bank’s services.

Service Delivered: Accessibility implementation for 53 multipage Word-based document templates using Quadient Inspire

Project Duration: Early March 2025 – April 2025

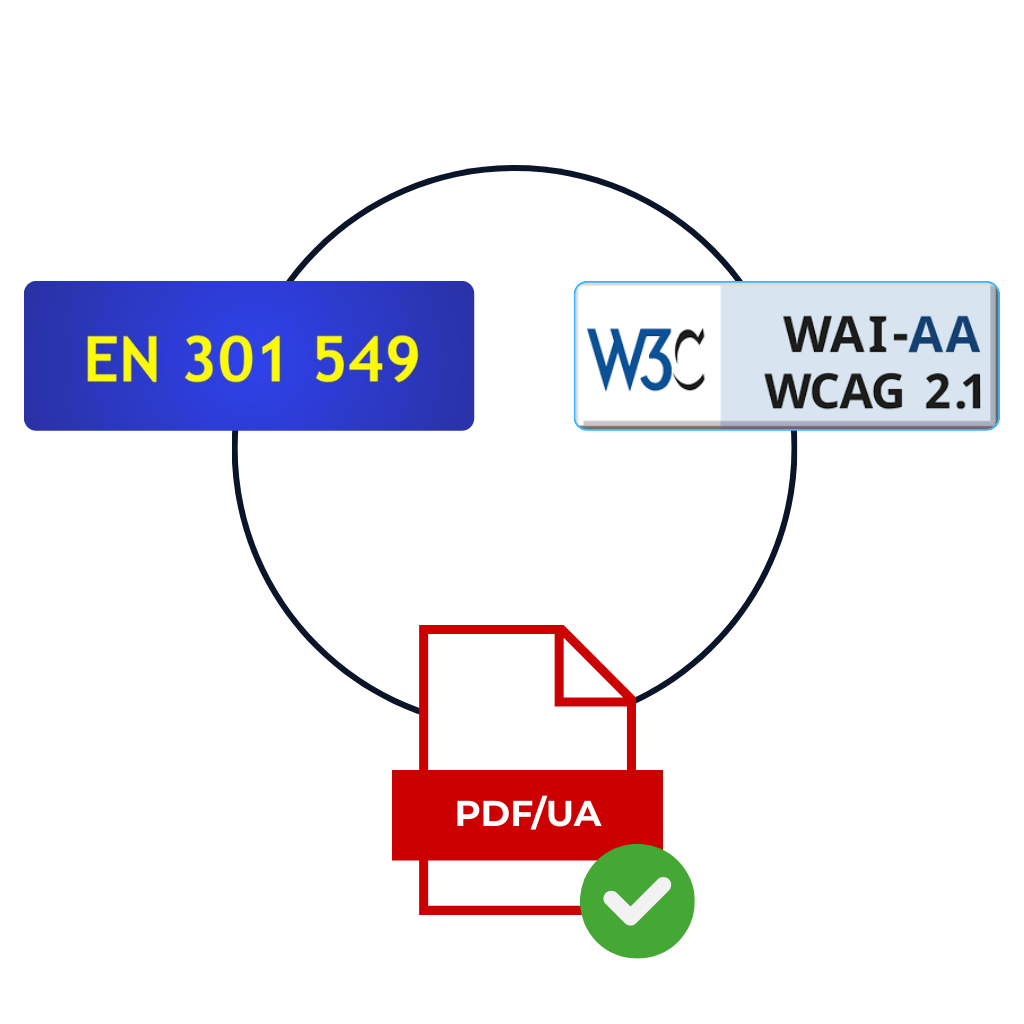

Challenge: Adapt high volumes of customer-facing documents to meet WCAG 2.1 AA, PDF/UA, and EN 301 549 accessibility standards within tight deadlines whilst maintaining document logic and operational continuity.

Outcome: 100% on-time delivery of accessible templates with zero disruption to customer communications, establishing a scalable process for ongoing EAA compliance across multiple departments.

Business Challenges: Scale, Speed, and Standards before EAA deadline

While accessibility was a new challenge for many teams within the industry, the bank team showed remarkable initiative and engagement to support their commitment to make the company inclusive and regulation-ready.

Same time bank’s team faced 4 interconnected challenges that made this project particularly complex:

1. High-Volume Delivery Under Tight Timelines

The most intensive project phase occurred in March 2025, requiring a high volume of documents to be adapted within a compressed timeframe. This added complexity and placed significant pressure on maintaining both speed and quality — two factors that typically conflict in accessibility implementations.

2. Technical Translation of Business Logic in CCM System

The bank needed to ensure templates met accessibility standards without compromising document logic or structure. Customer communications often contain complex conditional content, variable data fields, and regulatory disclosures that must remain accurate whilst becoming accessible. Translating this business logic into technically feasible templates within Quadient Inspire required deep expertise in both CCM platforms and accessibility standards.

3. Maintaining Quality at Scale

With multiple document types spanning different product lines and customer segments, the bank couldn’t afford inconsistent accessibility implementation. Every template needed to meet WCAG 2.1 AA, PDF/UA (ISO 14289), and EN 301 549 requirements uniformly, regardless of document complexity or department ownership.

4. Building Sustainable, Scalable Processes

This wasn’t a one-time remediation project. The bank needed an efficient, transparent process that could support ongoing rollout across additional departments as new templates were developed or existing ones updated. Accessibility had to become embedded in their document development workflow, not treated as an afterthought.

Project Goals: Building Trust Through Delivery

From the outset, the project was driven by clear, measurable objectives:

- Implement 53 Word-based templates by end of April 2025 – meeting both accessibility standards and business requirements without compromise.

- Deliver outputs fully aligned with bank’s internal and department’s specifications whilst offering constructive improvement suggestions that enhanced both accessibility and operational efficiency.

- Implement accessibility in a way that works seamlessly within existing CCM logic, ensuring no degradation during routine operations.

Implement EAA-ready Document Communications: Structured Collaboration and Clear Ownership

Phase 1: Laying the Groundwork Through Face-to-Face Engagement

The project began with a well-structured and collaborative setup designed to build trust from day one.

Quertum’s Project Manager and the implementation team travelled to Wrocław to meet the bank’s Product Owner in person. This initial face-to-face interaction helped establish rapport and engagement between:

- Solution architects from Quertum’s side

- Technical team leader from Quertum’s team

- A developer from the bank

- Members of the bank’s IT-related management

Further strengthening this foundation was the hands-on way our technical leads and solution architects approached the early phase of the project. Because our implementation team has spent years delivering CCM solutions in highly regulated environments, they navigated the bank’s architecture, approval flows, and operational specifics with ease. Instead of long discovery cycles or guesswork, early decisions were made quickly and confidently, the team understood how financial institutions structure their systems, govern changes, and protect customer communications.

Phase 2: Collaborative Template Development and Validation

With internal ownership on the client side, business teams prepared Word documents using newly developed accessibility guidelines aligned with WCAG 2.1 Level AA and EN 301 549. The templates were structured to support generating PDF outputs that meet PDF/UA requirements once implemented in the CCM system. These templates were then reviewed to:

- Validate document structure for accessibility compliance

- Map variables and conditional logic

- Assess technical feasibility for Quadient Inspire implementation

- Identify potential issues before development began

This joint review approach allowed both sides to address challenges early and ensured templates would meet accessibility requirements whilst functioning seamlessly from a technical standpoint.

Phase 3: Implementation with Built-In Quality Control

From the very beginning, we emphasised clarity of roles and robust process controls:

Core Implementation Team:

- Dedicated Business Analyst translating requirements into technical specifications

- Developer implementing accessible templates in Quadient Inspire

- Separate resource focused exclusively on code reviews

Quality Assurance:

- Standalone Quality Control step prior to deployment

- Rigorous testing against WCAG 2.1 AA, PDF/UA, and EN 301 549 standards

- Validation with assistive technologies (screen readers, keyboard navigation)

Project Coordination:

- Solution Architect providing overarching guidance and participating in daily meetings

- Real-time resolution of questions to prevent delays

- Project Manager tracking technical discussions and transforming them into concrete next steps

For the bank, having a consistent and responsive point of contact made a tangible difference. Consolidated updates, fast follow-ups, and minimal back-and-forth significantly eased internal coordination — a benefit highlighted by the client throughout the engagement.

Common Document Accessibility Issues We Identified and Resolved

During implementation, we encountered recurring accessibility barriers that every Product Owner managing customer communications and cares about accessibility should recognise:

1. Missing or Incorrect Tagging

Documents lacked semantic structure (headings, lists, tables) that screen readers rely on for navigation. We implemented comprehensive tagging that defines content hierarchy and reading order.

2. Absence of Meaningful Alternative Text for Graphics

Images, charts, and logos either had no alt text or used meaningless descriptions like “image1.png.” Our team created contextually appropriate alternative text that conveys visual information to screen reader users.

3. Improperly Defined Logical Reading Order

Document elements appeared in illogical sequences when read by assistive technology, despite looking correct visually. Our specialists established proper reading order that follows natural document flow.

4. Tables Used for Page Layout Purposes

Tables were misused for visual positioning rather than data presentation, confusing assistive technologies. We restructured layouts using appropriate PDF structure elements whilst maintaining visual design.

These issues are pervasive across the banking industry. Addressing them systematically at the template level ensures every generated document is accessible by design, the same time eliminating the need for costly per-document remediation.

Rigorous Testing and Continuous Improvement

During the testing phase, the bank’s testers identified a few issues requiring resolution. Whilst none fell outside acceptable limits for a project of this scale and complexity, their identification highlighted the importance of close collaboration and rigorous quality assurance.

Thanks to proactive involvement from both teams, all issues were addressed efficiently, ensuring continuity and confidence in the delivery process. This testing phase validated both the technical implementation and the effectiveness of our collaborative working model.

Over time, the bank began viewing Quertum not merely as implementers executing specifications, but as strategic partners contributing expertise that strengthened their overall approach.

Key Results: EAA-ready Document Communications

53 multipage Word-based Templates became Fully Accessible

Accessibility implemented at the template level ensures the rendered PDF meets PDF/UA, WCAG 2.1 AA and EN 301 549

Full Integration with the Bank’s CCM Quadient Inspire

The Competitive Advantage of Early Adoption

Whilst most Polish banks are still assessing EAA requirements, this institution has:

- Established proven accessible template processes

- Built internal competencies through partnership

- Eliminated compliance risk for implemented document types

- Positioned themselves to capture the 24% of EU citizens with disabilities as loyal customers

More importantly, they’ve demonstrated that accessibility implementation, which done correctly, doesn’t disrupt operations, compromise document quality, or create unsustainable costs. It’s an investment that pays dividends in customer trust, regulatory confidence, and operational efficiency.

Ready to Implement Template-Based Accessibility for Your Institution?

Quertum has delivered accessible document solutions for leading European banks, insurers, and financial services organisations. Our expertise in Quadient Inspire and other CCM platforms, combined with deep accessibility knowledge, ensures implementations that meet both business requirements and regulatory standards.

Contact us for a consultation on template-based accessibility implementation, or explore our PDF accessibility services to learn how we help financial institutions achieve EAA compliance at scale.

Let’s drive your Digital Transformation Together.

Schedule a free consultation with our team to explore how we can help you achieve your goals.